for tech INVESTORS BY tech founders

like a music production to a band, StudioAlpha is a founders FUND that invests in early stage startups and works with them to grow fast.

THE 5TH BEATLE: Your role

Studio Alpha team

The StudioAlpha team has been knowing each other for more than 20 years:

- Stefan Arn, former CIO UBS, founder & former CEO Adnovum

- Dr. Andrey Vckovski, founder & former CEO Netcetera

- Fabian Hediger, founder & former CEO Beecom and Worldwebforum

- Prof. Dr. Andreas Ziltener, founder Beecom and Worldwebforum

- Lukas Rüfenacht, founder DELUK, art director Beecom

We are looking for investors that support our mission.

play in san francisco, singapore

In our concise 100-day production-program, we collaborate intimately with founder teams, equipping them for the forthcoming entrepreneurial adventure. Biannually, participants present their product and market fit to venture capital investors from our San Francisco and Singapore network.

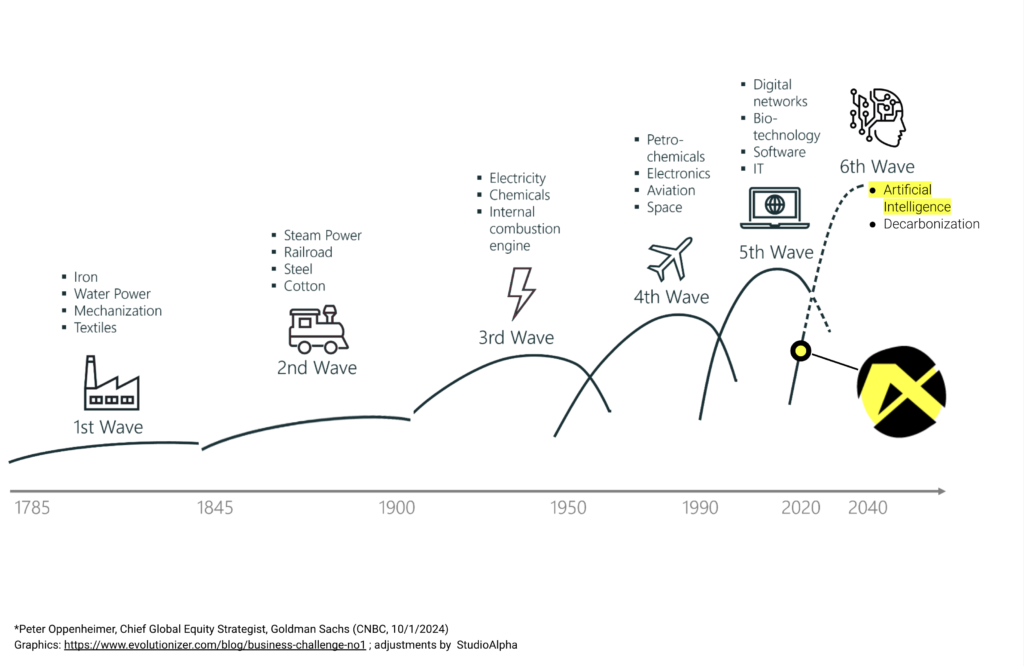

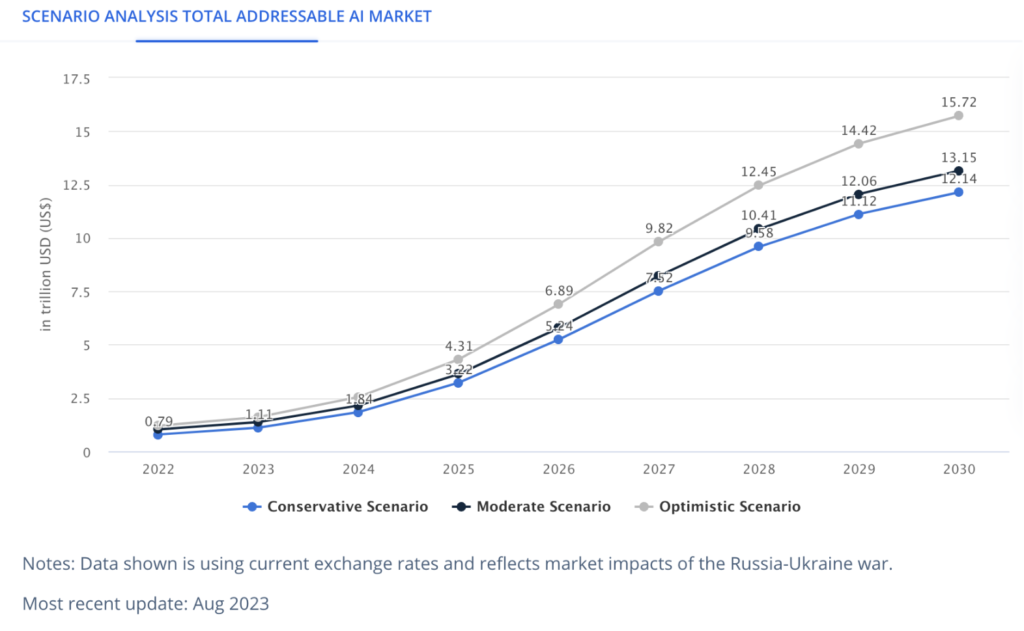

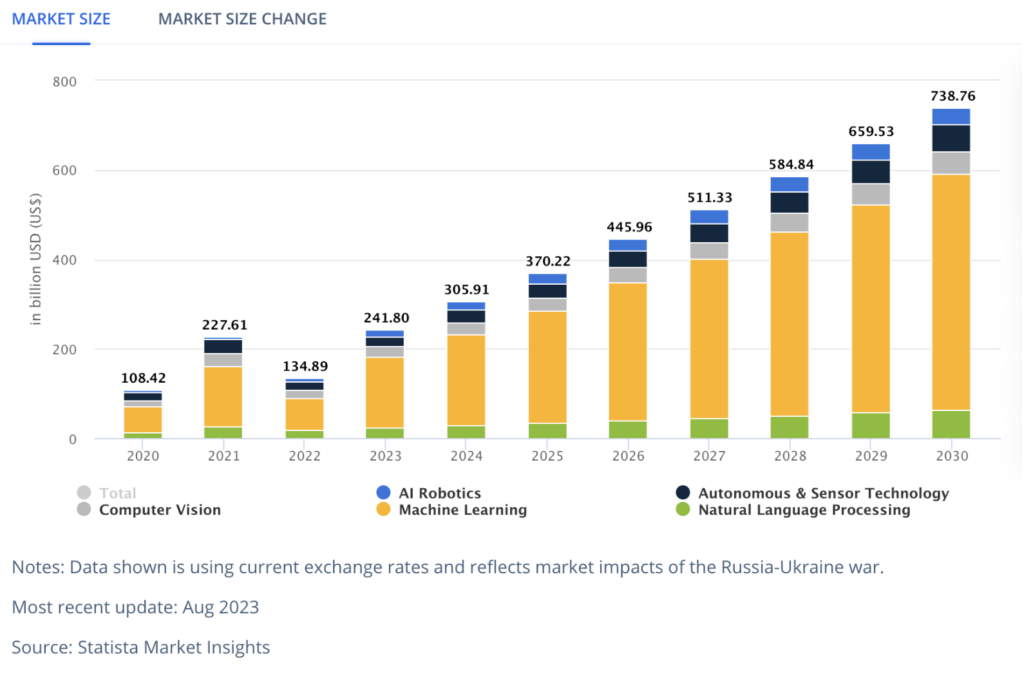

AI Growth forcast CAGR 2024-2030: 15.83%

The AI industry is poised for rapid expansion by 2030, with all sectors showing promising growth. StudioAlpha is strategically positioned to leverage this cycle.

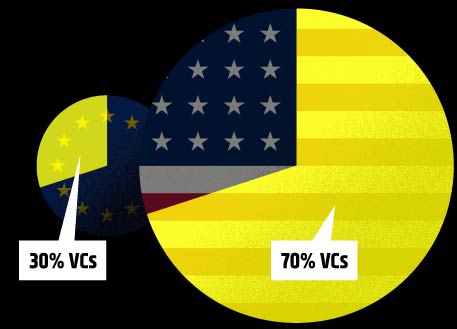

A HIGH PERCENTAGE OF U.S. INVESTORS ARE EX-FOUNDERS

In the U.S., over 70% of venture capitalists are former founders who have transitioned from building their own companies to investing in others like us. In contrast, this rate drops to less than 30% in Europe.

For emerging companies, partnering with investors who boast entrepreneurial experience can be invaluable. They possess a firsthand understanding of your challenges and can offer empathetic, experienced-based guidance.

Image. Proportion of former founders among VC in %

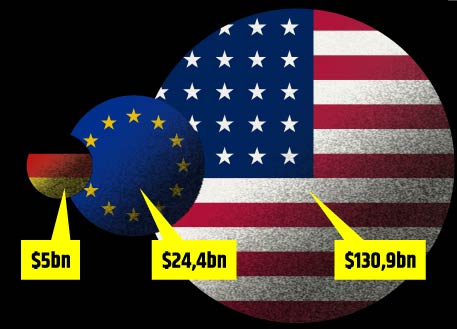

go where the money is

Before the COVID pandemic, the U.S. saw venture capital investment five times greater than that in Europe, despite Europe having a third more population. However, both regions fund a roughly similar number of startups.

This comparison, though, doesn’t paint the full picture. The U.S. benefits from a single, unified market with one primary language and a consolidated legal framework, unlike Europe’s 47 diverse nations, each with its own tax regulations. Consequently, Germany, Europe’s largest single market, is still 26 times smaller than the USA, illustrating a different scale of opportunity from an investor’s perspective.

Image. Venture capital investments by region, in bn $

Startups fortified in the US have a greater opportunity to thrive globally and can then effectively conquer European and other markets.